THE ADVANTAGE

Your monthly recap of the most important

mortgage-related news, perspective, and advice

January 2024

4 minute read

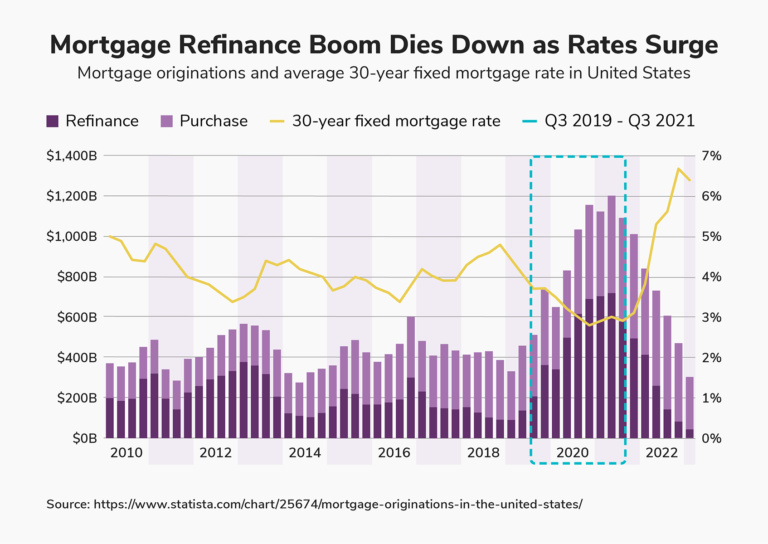

Remember when mortgage refinance revenue nearly doubled between the third and fourth quarters of 2019? Falling interest rates accelerated by the pandemic created a surge of members wanting to refinance, placing incredible strain on lenders.

Many lenders found it hard to keep up. Some even tightened approval criteria making it harder to qualify. By Q3 of 2021, homeowners who hadn’t yet started the refinance process began fearing they might miss out on the low rates.

And many of them did.

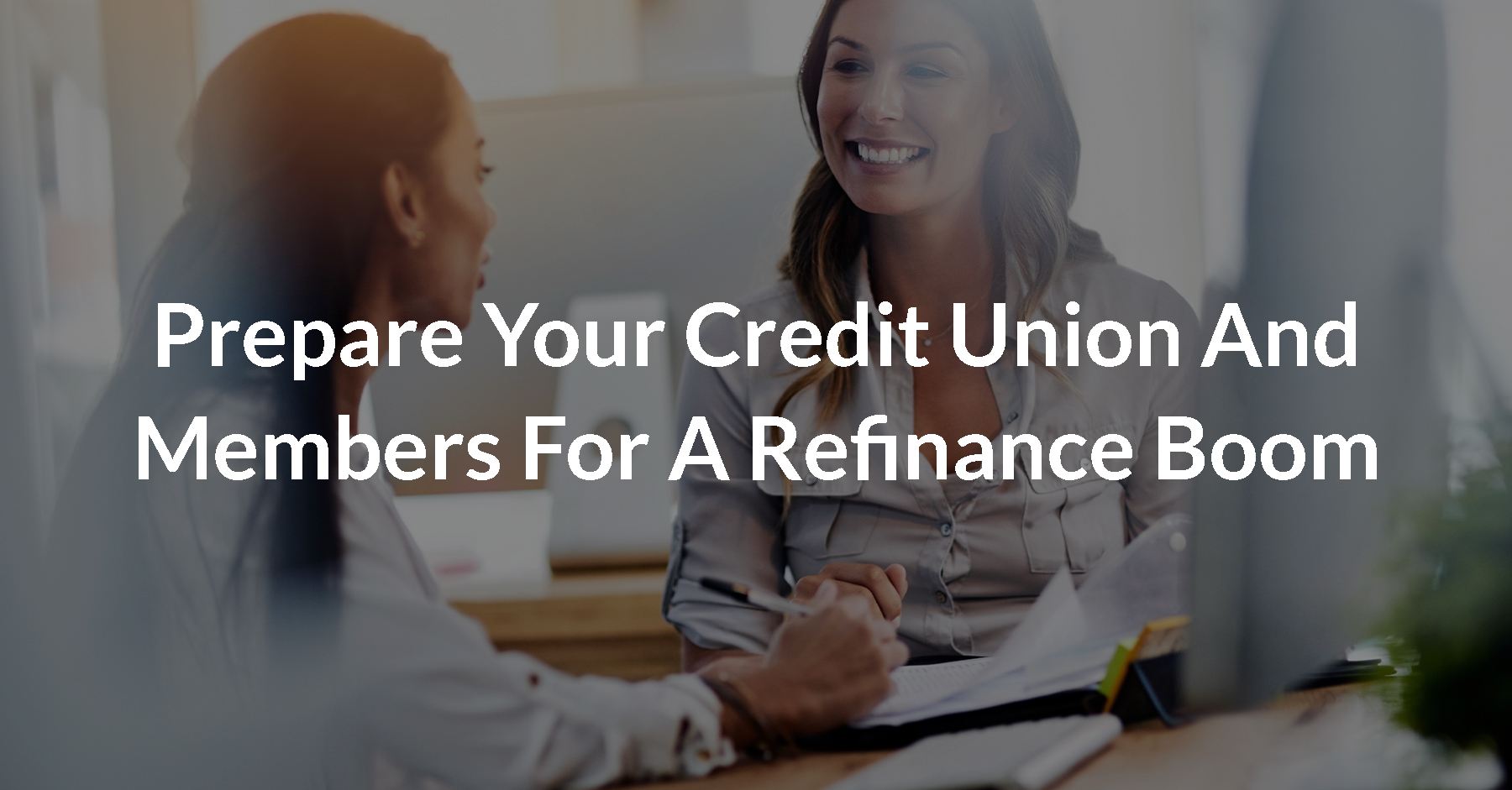

So let’s make sure both your institution and your members are ready for the next refinance boom.

Preparing Members for the Next Refinance Boom

Federal Chair Jerome Powell said “The appropriate level of the federal funds rate will be 4.6% at the end of 2024”, hinting that mortgage interest rates will continue to fall this year.

Given that rates remained above 7% between August and December last year, your members are most likely quite anxious for rates to keep going down.

Here are some tips to help your credit union keep up with demand when members are ready to refinance.

- Start the pre-approval process now.

Members may not realize the application process for refinances takes time. They may want to start the process so they’re able to lock in a rate once they drop to their liking. Just keep in mind that rates change significantly even in a day, so waiting to prepare in a fluctuating rate environment can impact the monthly payment.

- Keep an eye on the rates.

Our Mortgage Calculators are great tools to help members know what their mortgage payment would be given the current rates. Freddie Mac also publishes the 30-year fixed-mortgage interest rate every week here. Both resources are worth keeping an eye on.

- Maintain good credit.

Members may forget that opening a new line of credit, closing credit cards, or even changing jobs may impact their credit score and ability to qualify for a refinance. Remind them to maintain the same credit vigilance they had when first buying their home. This article may also help.

- Set a target interest rate.

When rates are falling, it’s tempting to see how low they’ll go. But members don’t want to gamble with something this important. Encourage them to figure out the rate they want, and to refinance when it arrives. Getting a rate you’re happy with is better than missing out if rates go back up.

Preparing Your Credit Union

In order to capture the most refinance revenue, you’ll need to be able to handle applications quickly and efficiently, while supporting members as they go through the application process.

Member Advantage Mortgage can help you with both! We can handle the mortgage process from start to finish for our partnering credit unions, taking burdensome tasks off their plates.

Capture more volume during the next refinance boom by partnering with MAM. Contact Jim Mitchell for more information at (616) 466-7793 or [email protected].

Timely Topics:

Give Your Credit Union An Even Bigger Advantage

Get The Advantage delivered right to your inbox

Who Is MAM?

Member Advantage Mortgage (MAM) is a Credit Union Service Organization (CUSO) that helps credit unions increase revenue by offering mortgage solutions to their members.

We achieve this by finding the mortgage solution that is in each individual member’s best financial interest.

What We Do

Since 2006, MAM has offered first and second mortgage origination and fulfillment services to credit unions. We also provide marketing tools (like our Mortgage Payment Calculator) to increase lead generation.

![]()

How We Can Help You

We’ll help you improve member satisfaction and deepen member relationships by offering or streamlining your mortgage delivery process. You’ll be able to serve current members so they don’t need to turn to the competition, all while increasing your mortgage revenue and generating non-interest income.

How You Can Learn More

This page goes into greater detail on exactly how we provide support and partner with credit unions.

You can also call Jim Mitchell, our Senior Vice President of Strategic Partnerships, to get answers to any questions about partnering with MAM.

Disclaimer:

This information is solely for credit union and mortgage professionals and should not be distributed or provided to consumers or the general public.

This is not an offer for extension of credit nor a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. Certain restrictions may apply. All approvals subject to underwriting guidelines. Not all applicants will qualify. Member Advantage Mortgage, LLC is an Equal Housing Lender. We do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.

Member Advantage Mortgage, LLC NMLS #1557. Alabama Consumer Credit License # 22717. Arkansas Combination Mortgage Banker-Broker-Servicer License # 104160. Colorado, Regulated by the Division of Real Estate, Mortgage Company Registration NMLS ID # 1557; check the license status of your mortgage loan originator at http://www.dora.state.co.us/real-estate/index.htm. Connecticut Mortgage Lender License # ML-1557. District of Columbia Mortgage Lender License # MLB1557. Delaware Lender License # 011515. Florida Mortgage Lender License # MLD781. Georgia Residential Mortgage Licensee, License # 36659. Louisiana Residential Mortgage Lending License NMLS ID # 1557. Massachusetts Mortgage Lender License # ML1557. Maryland Mortgage Lender License # 06-19371. Michigan 1st Mortgage Broker/Lender/Servicer Registrant # FR020440. Licensed by the North Carolina Commissioner of Banks, Mortgage Lender License #167098. Licensed by the New Hampshire Banking Department. New Hampshire Mortgage Banker License # 14242-MB. Licensed by the New Jersey Department of Banking and Insurance. New Jersey Residential Mortgage Lender License NMLS ID # 1557. Licensed by Pennsylvania Department of Banking. Pennsylvania Mortgage Lender License # 33868. Rhode Island Licensed Lender, License # 20112778LL. South Carolina Mortgage Lender License #1557. Texas Mortgage Banker Registration NMLS ID # 1557. Licensed by the Virginia State Corporation Commission, Virginia Lender License # MC-5045, Virginia Broker License #MC-5045. NMLS ID # 1557.

Visit www.nmlsconsumeraccess.org for complete licensing information.