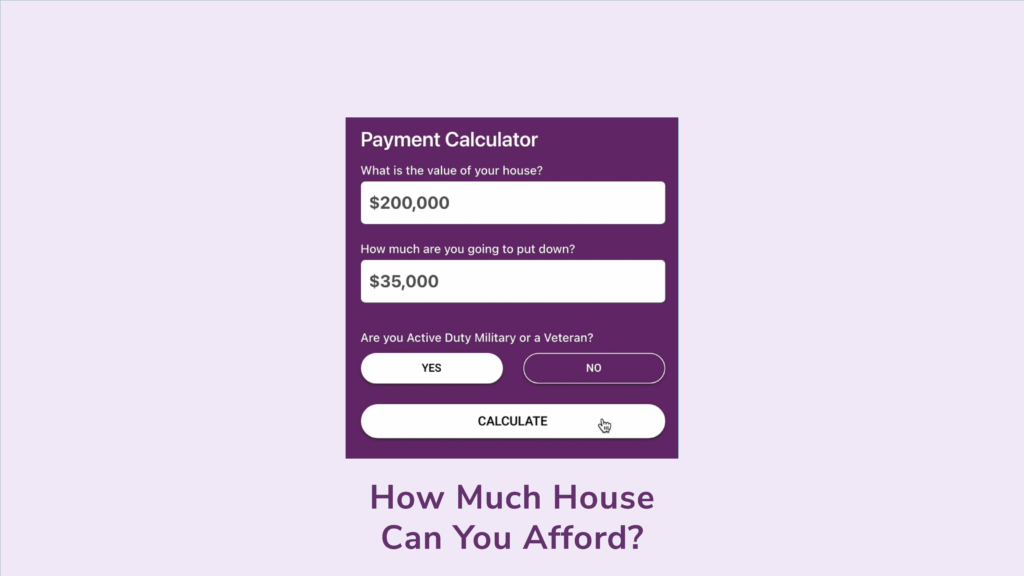

How Much House Can You Afford?

Prequalification vs. Preapproval

How Much Home Can You Afford?

When trying to figure out how much home you can afford, there are a lot of factors to consider. This article will walk you through some things to think about before you start shopping for your next home. Key Takeaways Your debt-to-income and housing expense ratios are key factors in determining how much money […]

The Difference Between a Prequalification and a Preapproval

If you’re shopping for a mortgage, you’ve likely heard the terms “prequalification” and “preapproval”, and are wondering how they differ. Many lenders use these terms interchangeably, but they are not the same thing. They are both actions a lender takes to determine how much money is appropriate to lend you. The difference lies in how […]

Stages of the Mortgage Process

This article explains the five primary stages of the mortgage loan process. There may be steps in addition to what’s covered here, but in general this article will let you know what to expect. Key Takeaways It’s a good idea to do a self-evaluation of your finances before applying for a mortgage. Your information […]

What a Lender Looks for During an Appraisal

Whether you’re buying, refinancing or selling a home, one unavoidable step in the process is a home appraisal. While there’s not much you can do to prepare for one, you can go into it knowing exactly what a lender is looking for and why it’s happening. What is a home appraisal? A real estate […]