Key Takeaways

- PMI is insurance that protects the lender and is required on conventional loans where the down payment is less than 20% of the home price

- There are some loans that don’t require PMI

- There are ways to avoid PMI or have it removed

You’ve been dreaming of the day you’ll get the keys to your new home. You’ve been saving for that down payment, but houses are expensive, and you don’t yet have 20% for a conventional down payment.

Your mortgage options look good, but you’re wondering if there’s a way to get around paying private mortgage insurance (PMI). We have good news for you: there are many alternatives to PMI.

What is PMI?

Private mortgage insurance, or PMI, is insurance you’re usually required to pay when your down payment on a conventional loan is less than 20% of the home value. PMI protects the lender if you stop making payments.

The average cost of PMI for a conventional home loan ranges from 0.5% to 1.5% of the loan amount on an annual basis. What you pay for PMI largely depends on your down payment and credit score.

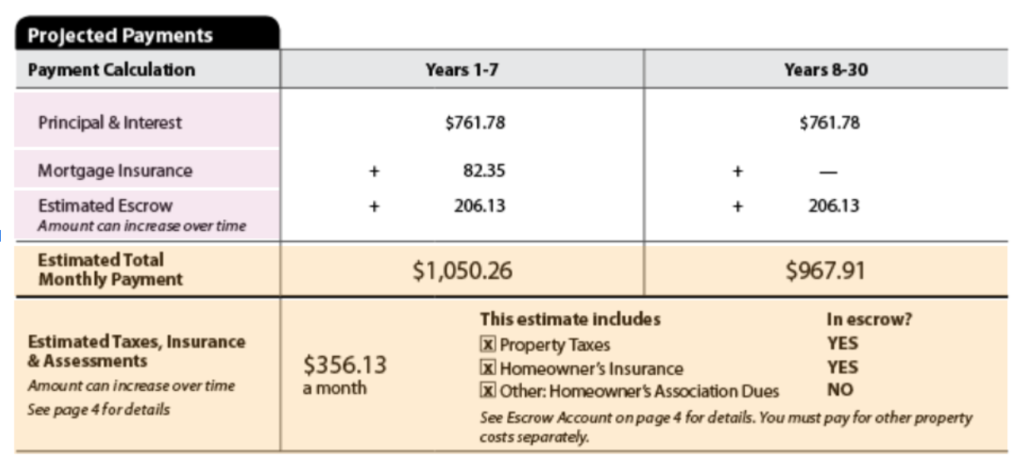

PMI is usually added to your monthly mortgage payment. If it’s required, you’ll find it on your Loan Estimate and Closing Disclosure next to “Mortgage Insurance.”

Alternatively, PMI is sometimes paid at closing as a one-time up-front premium. Ask your lender how they structure PMI and what alternatives they offer.

Why would you buy discount points?

As you know, your personal financial situation determines your loan terms. If you have excellent credit, a reliable income, and not too much debt, you’re going to qualify for the best interest rate. Real life is a bit messier for most of us, though, and a lender may offer a rate that is higher than you prefer to pay. If other aspects of your home loan are within your plan and budget, but your interest rate isn’t as low as you’d like, that’s where discount points can be extremely helpful.

Another way to think of it is that by buying a point, you are prepaying interest to obtain a lower monthly payment. Buying discount points to lower your interest rate can save you thousands of dollars over the life of the loan, provided you plan to live in the home long enough to recover what you paid up front for the lower interest rate.

Avoiding PMI

There are three main strategies for avoiding PMI when you put down less than 20% on your new home.

- Find a program that doesn’t require PMI

- Use lender-paid mortgage insurance (LPMI)

- “Piggy back” with a second mortgage

Earlier, we mentioned that PMI is usually tied to conventional loans. A “conventional loan” is a mortgage that’s not insured by the federal government. These mortgages are often offered by private lenders.

- VA loans: Home loans from the U.S. Department of Veterans Affairs (VA) help service members, veterans and their surviving spouses become homeowners. You don’t need a down payment, and there is no PMI.

Unless you qualify for an exemption, you’ll pay a one-time funding fee, but overall, the cost is usually lower than a similar conventional loan with PMI. Plus, VA loans usually come with low interest rates, making them a fantastic option for qualifying buyers.

- Conventional loans: Some lenders offer conventional loans that do not require PMI, even if your down payment is under 20%. These loans often apply to specific buyers, like first-time homeowners, teachers, doctors, or farmers.

Removing PMI

Even if your loan has PMI, you might not have to pay it forever. PMI is removed in one of two ways: you can request to have it removed once you have enough equity in your home, or you can wait until PMI automatically drops off.

Once your loan’s principal balance drops to 80% of your home’s value (also referred to as your Loan-To-Value ratio), you can submit a request to your lender to remove PMI. However, you will need to prove that the value of your home has increased enough, which will generally mean you have to pay for a new appraisal. If the home doesn’t appraise for enough to eliminate the PMI, you’ll be out the cost of the appraisal, so you want to be confident before you make the request.

Most lenders also require you to keep mortgage insurance for at least 2 years, so even if your home has gone up significantly in value in the first couple of years, you may have to wait to request its removal.

Once your Loan-To-Value ratio reaches 78% of the original home value, the lender is required by law to remove PMI for most mortgages, whether you request it or not, assuming you’re all caught up on your mortgage payments.

Don’t get stuck with PMI forever

PMI makes it possible for you to afford a home sooner, sometimes years before you’d otherwise be able to save up 20% for a down payment. But that doesn’t mean you’re stuck with it — or that you even need it in all situations.

Reach out today to find out how you can avoid PMI and buy your home with the down payment you have. Or explore how refinancing could eliminate your PMI sooner.