The 2008 housing market crash was largely blamed on two factors: not enough lender regulation (which led to predatory lending), and consumers not understanding the terms of their mortgages.

In the years since that crash, Adjustable Rate Mortgages (or ARMs) have been villainized, since they were the mortgage product of choice during that time. But they’re making a comeback.

We discuss when to consider an ARM here, as there are some scenarios when they could be advantageous.

Even still, there are associated risks with an ARM that buyers must understand. Please reference this article for a refresher on how ARMs work.

A Quick Recap

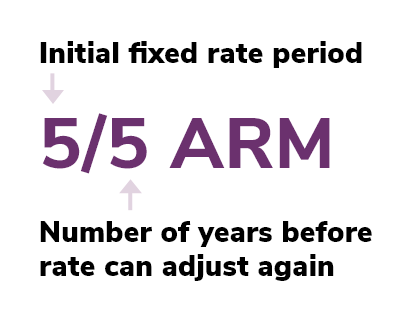

ARMs are referenced by two numbers separated by a slash (see graphic below). The first number references the length of the “initial fixed rate period” during which the rate won’t change. The second number indicates how often the rate is allowed to change once the initial period has expired. Historically both numbers have been expressed as years, but more recently some are expressed as months, so you’ll want to be sure you talk to your Mortgage Loan Officer to be clear on what each number represents.

What’s important to know for our purposes here is that there is a period of years where the rate doesn’t change, then a set interval during which the rate does change.

A Few Words Of Caution

The primary benefit of an ARM is the lower interest rate during the initial fixed rate period.

If that rate does not provide significant savings compared to the current fixed rate, then it would likely be unwise to take out an ARM.

The other big consideration is no one knows what will happen to interest rates. Homeowners who take out an ARM oftentimes plan on either selling their home, or refinancing before their rate adjusts.

Your finances must be able to weather the storm if for some reason you are not able to sell, you have trouble qualifying for a refinance (for example, if you lose your job), or if fixed rates aren’t favorable for refinancing.

Repayment Options and Requirements

Some lenders also include additional options like interest only payments and negative amortization, or repayment requirements like balloon payments. It’s important to watch for these terms since they introduce added risks you must understand before electing to take out an ARM with any of these features. Here’s a quick synopsis of each.

- Interest Only Payments – With an interest only payment, the homeowner can make a smaller monthly payment since they don’t pay any principal, but that means their loan balance will not decrease. They’ll pay the same interest the following month, and long-term interest only payments don’t build equity in a property, so you only gain equity if the value increases.

- Negative Amortization – This allows the borrower to pay less than the total interest due on the outstanding loan balance each month. The leftover (unpaid) monthly interest amount is added to the outstanding loan balance which means that the amount of monthly interest accruing on the outstanding loan balance continues to rise each month. Unless your home’s value is increasing faster than the balance on your mortgage, you may risk losing any equity you have in the home and could find yourself owing more than the home is worth at some point.

- Balloon Payments – This is lump sum repayment of the entire balance of the loan, that is usually required no sooner than 15 years after the ARM is taken out. It is often combined with interest only or negative amortization options, as those options could be abused by homeowners who stall repaying their loan indefinitely. If the balloon payment isn’t made, the homeowner risks the lender foreclosing on their home.

Generally speaking, these features only add benefit for borrowers with higher net worth who have greater financial flexibility and may have alternative uses for their money that offer a higher return than what they’re paying in interest on their mortgage. Even if those alternative uses don’t pan out as expected, these individuals have the finances to not experience significant harm to their economic well-being.

The bottom line is that ARMs do offer some key advantages in certain situations, but they also come with added risks you must understand on the front-end.

The Consumer Financial Protection Bureau has regulations in place so lenders must disclose the terms of a mortgage to the buyer before anything is signed, but it is ultimately the buyer’s responsibility to make sure they understand the terms they’re agreeing to.

While some lenders feel their disclosure paperwork is enough, we believe that working with a credit union can help diminish your risk because credit unions are nonprofit entities that place the highest priority on serving members rather than maximizing profits.

Be sure to work with an experienced and knowledgeable lender who will take the time to answer your questions and explain the pros and cons to you.