THE ADVANTAGE

Your monthly recap of the most important

mortgage-related news, perspective, and advice

January 2023

Using Historical Trends To Predict the Housing Market’s Future

5 minute read

Unfortunately, crystal balls do not predict the future.

History, however, has a tendency of repeating itself. Sometimes, that is a good thing.

We need to ask history to teach us her lessons so we can best prepare for the months to come. While we may still not know exactly what lies ahead, many experts predict good things for the 2023 housing market.

Home Values Increase Over Time

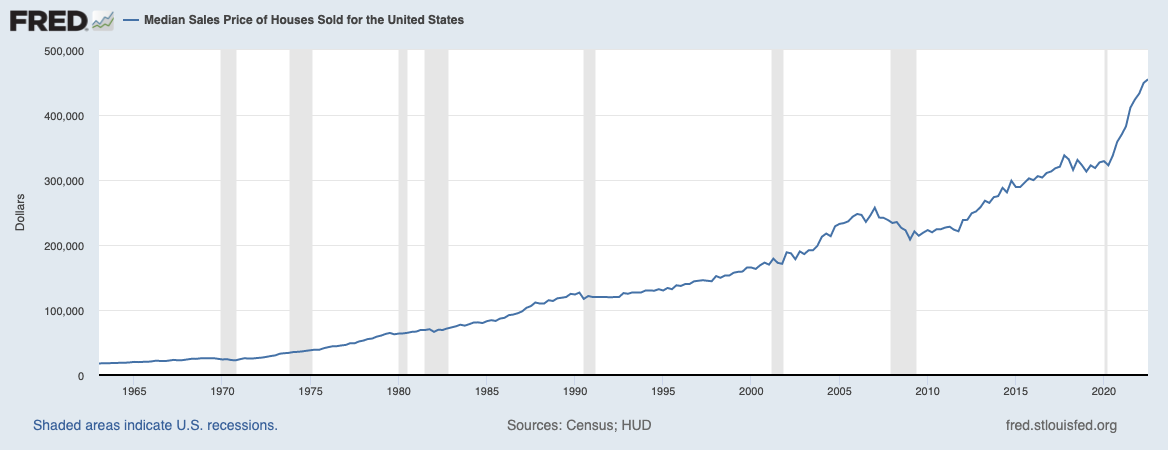

Looking at the Federal Reserve’s Economic Data (FRED)’s graph below, it’s clear to see that home values tend to increase over time.

In fact, home values are up for the 129th month in a row, which is the longest running streak on record. Home sales are currently down, but values are growing, meaning there is no reason to conclude that high rates are going to cause market instability.

How The Federal Reserve Impacts Rates

The Federal Reserve exists to ensure the economic stability of our nation’s financial institutions, and impacts the state of the mortgage industry by influencing mortgage interest rates.

When interest rates are low, mortgage lending income suffers, leaving credit unions and banks with less ability to lend to other homebuyers. For the last several months, the central bank has instituted a monetary policy known as Quantitative Tightening (QT), in order to raise interest rates until financial institutions have the minimum level of reserves they need to operate without assistance from the government.

The last time the central bank undertook a QT program was between 2017 and 2019. It ended abruptly when financial institutions met what is known as the lowest comfortable level of reserves (LCLoR). At the current rate, some believe the LCLoR could be reached as soon as February 2023.

Once QT ends, rates will most likely fall, introducing an influx of buyers into the market.

Rates Are Decreasing, and Buyers Are Coming

Yes, mortgage interest rates have gone up, and higher rates have prevented some buyers from qualifying for a mortgage. But those buyers aren’t gone, they’re just waiting.

According to Freddie Mac, “Over the last few weeks latent demand has been on display with buyers jumping in and out of the market as rates move.”

National Association of Realtors Chief Economist Lawrence Yun said: “The market may be thawing since mortgage rates have fallen for five straight weeks.”

Relative to the last 15 to 30 years, mortgage interest rates are still attractive to many homebuyers. Buyers who are still in the market also finally have a bit of negotiating power with sellers.

Our Advice Is: Get Ready!

Yes, it may be a slow first quarter, but when you analyze the data, and look at historical trends — there is light ahead for the 2023 mortgage industry.

The point is you need to get ready for buyers now. Next month we’ll discuss the importance of mortgage marketing, and some related tips.

Timely Topics:

Give Your Credit Union An Even Bigger Advantage

Get The Advantage delivered right to your inbox

Who Is MAM?

Member Advantage Mortgage (MAM) is a Credit Union Service Organization (CUSO) that helps credit unions increase revenue by offering mortgage solutions to their members.

We achieve this by finding the mortgage solution that is in each individual member’s best financial interest.

What We Do

Since 2006, MAM has offered first and second mortgage origination and fulfillment services to credit unions. We also provide marketing tools (like our Mortgage Payment Calculator) to increase lead generation.

![]()

How We Can Help You

We’ll help you improve member satisfaction and deepen member relationships by offering or streamlining your mortgage delivery process. You’ll be able to serve current members so they don’t need to turn to the competition, all while increasing your mortgage revenue and generating non-interest income.

How You Can Learn More

This page goes into greater detail on exactly how we provide support and partner with credit unions.

You can also call Del Smith, our Senior VP of Business Development, to get answers to any questions about partnering with MAM.

Disclaimer:

This information is solely for credit union and mortgage professionals and should not be distributed or provided to consumers or the general public.

Member Advantage Mortgage LLC (MAM) is a subsidiary of CUSO Development Company (CDC), which is owned and operated by credit unions for the benefit of credit unions and their members. Member Advantage Mortgage, LLC NMLS #1557. Visit www.nmlsconsumeraccess.org for complete licensing information.