You’re likely seeing headlines that talk about housing bubbles and crashes, and compare today’s housing market to 2008.

There’s no sugar coating that home prices are still high, interest rates are increasing, and we’re facing record inflation. But is that cause for panic? Does it mean we’re headed for another crash? Most housing experts say no, we’re not.

As a consumer, especially if you’re considering buying a home, it is imperative that you look at historical trends and data to help you determine whether the news you’re hearing is true or not.

Key Takeaways

- Historically, high interest rates don’t cause home values to fall.

- Housing corrections occur regularly, but receive a lot of attention because of the notable housing crash in 2008.

- Housing crashes like we saw in 2008 are few and far between. Experts agree, we don’t appear to be headed into a housing crash or crisis.

The big problem with “recency bias” and negative headlines

Psychologically, we place a higher value on recent events than we do on past events. This bias towards the immediate past is called recency bias.

The housing crash of 2008 is still in our recent history. Looking back, we can see how low lender regulations, rising home values, and low interest rates all came together to form a housing bubble — which had devastating effects on the economy when it popped.

Potential home buyers look around today, and see similar signs. The media churns out negative headlines, which people believe because of their recency bias, and voila, people are fearful and reluctant to buy a home.

Understanding trends is a great way to fight fear

Will there be another housing bubble and crash? Are the headlines accurate? Or does the historical data tell a different story?

No one can predict the future, but we believe the future of the housing market will be brighter than some of the headlines may lead you to believe. Here’s why.

1. Prior to 2008, the last major housing crash was caused by the Great Depression

In 1929 home prices fell by 67%, and property values dropped so dramatically that it took the end of World War II for the market to recover. Compare that to 2008, where home values fell by 9.5% and essentially recovered four to five years later, and the recent crash doesn’t seem as bad. Economists estimate housing prices will fall by about 5% in 2023, but regain 3% in 2024. This makes the term “housing correction” more appropriate than “housing crash.”

2. Housing markets are resilient

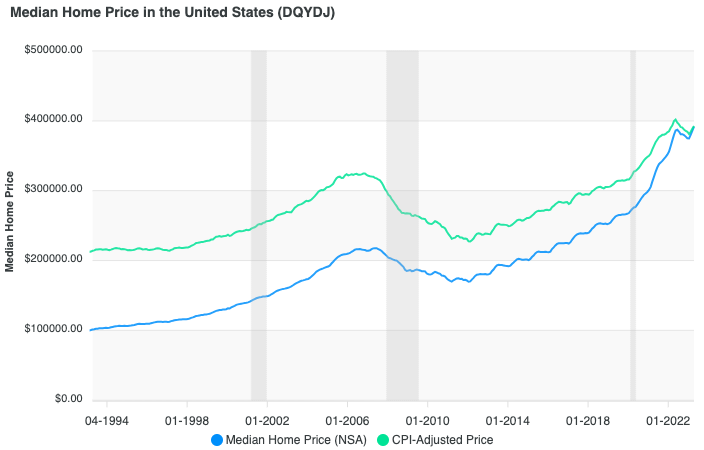

Housing prices go through cycles. Over time we see prices rise, fall, then rise again. They tend to trend upwards, usually only falling to the point of the previous peak. Looking at the graph below you can see this trend. The CPI index (green line) takes inflation into account to better show what median home prices actually look like.

3. Mortgage rates haven’t impacted home prices in 40 years

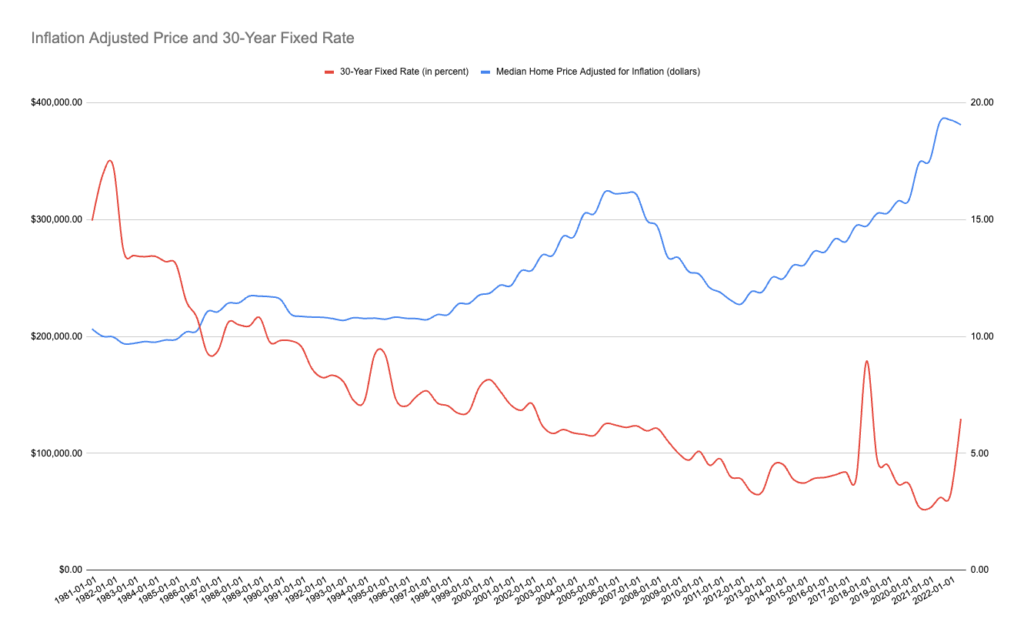

Rising interest rates are often blamed in the media for falling home values. The logic says the higher the rates, the less affordable homes become. There will be less demand for homes, so given what we know about supply and demand, prices will fall.

It sounds good, but if that were true, a graph of median home values would show decreases every time the interest rate spiked. Looking at the below graphs you’ll be able to tell — high interest rates don’t cause home values to drop.

Note: Home values are adjusted for inflation to show values in today’s dollars. Graphing actual values would show a biased increase in values because home values have changed so drastically over time.

It doesn’t take that keen of an eye to see that in the past 40 years, home values have trended upward, while interest rates have trended down.

The big takeaway here is while home prices, interest rates, and inflation are going up — the data suggests we are not headed for a housing market crash, and most financial economists agree.

Do you have questions? We can help.

While it’s important to look at national trends, we realize the numbers can still be a bit tricky to understand. The most important trend we haven’t looked at is what’s trending in your life.

Are you ready to settle down and start a family? Perhaps you’re an empty nester ready to downsize? Life events will continue no matter what the market is doing, and we’ll be here to help you along your home-buying journey whenever you’re ready.