THE ADVANTAGE

Your monthly recap of the most important

mortgage-related news, perspective, and advice

May 2023

3 minute read

Since our inception, Member Advantage Mortgage (MAM) has added over $2 billion in mortgage generated income to our partnering credit unions books.

While the benefits of offering mortgages to your members are staggering, there are some risks and concerns associated with it. Thankfully, those worries are greatly mitigated simply through your partnership with MAM.

Oversight and Compliance

Regulatory and compliance information surrounding credit unions offering mortgages is quite complex, and frequently changing. The National Credit Union Administration (NCUA) reviews all of their policies every three years, meaning there’s a potential for change just when you’ve figured things out.

Regulators are avid about holding financial institutions accountable for anything they feel constitutes an unfair lending practice. That can be a costly, time-consuming endeavor even when they’re wrong and a lawsuit isn’t justified.

MAM partners with an outside compliance organization to ensure our marketing collateral is always up-to-date with current best practices. This gives our partnering credit unions peace of mind when sharing our content with their members.

The Cost of an Internal Mortgage Department

The process of hiring, training, retaining, and managing the number of full time employees required to run an effective in-house mortgage department can be astonishing.

At the end of Q2 in FY 2022, the Mortgage Bankers Association topped out the average cost per loan for mortgage lenders at nearly $11,000 per loan. That’s a huge chunk of change, especially for a smaller credit union attempting to compete against Goliath-sized national banking institutions.

It forces you to consider whether internal mortgage teams are worth the cost.

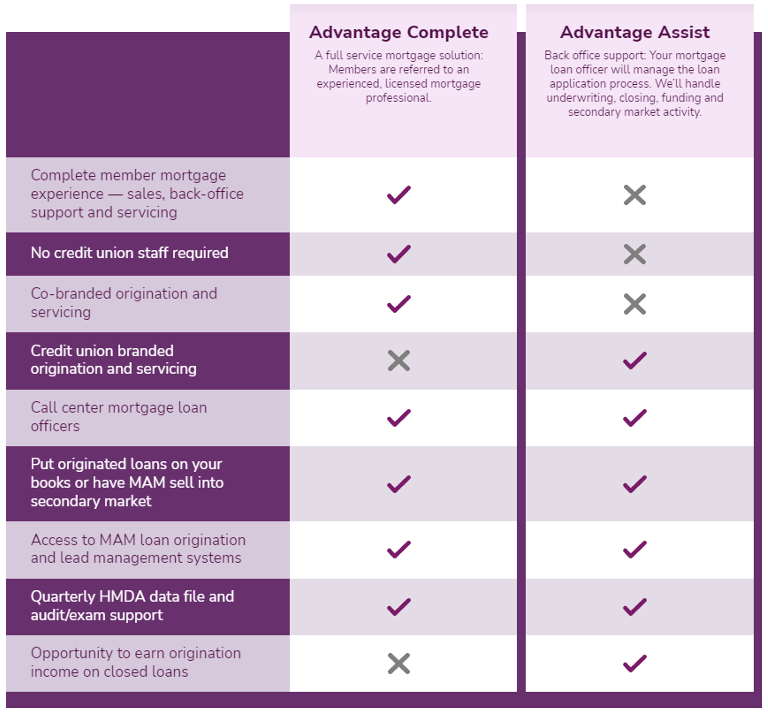

MAM can help your credit union lower your cost of offering mortgages, whether you’d prefer an end-to-end mortgage solution or just assistance with back-office processes.

Choose Your Advantage

No matter which one you choose, we will work hard so that:

- You have the widest breadth of offerings, including custom solutions.

- Members receive the type of full-level service they expect and deserve.

- Your volume needs are met as market fluctuations cause mortgage demand to ebb and flow.

Contact us to learn more about how MAM can lower your risk, keep you compliant, and provide a cost-effective and profitable pathway to offering mortgages to your members.

Timely Topics:

Give Your Credit Union An Even Bigger Advantage

Get The Advantage delivered right to your inbox

Who Is MAM?

Member Advantage Mortgage (MAM) is a Credit Union Service Organization (CUSO) that helps credit unions increase revenue by offering mortgage solutions to their members.

We achieve this by finding the mortgage solution that is in each individual member’s best financial interest.

What We Do

Since 2006, MAM has offered first and second mortgage origination and fulfillment services to credit unions. We also provide marketing tools (like our Mortgage Payment Calculator) to increase lead generation.

![]()

How We Can Help You

We’ll help you improve member satisfaction and deepen member relationships by offering or streamlining your mortgage delivery process. You’ll be able to serve current members so they don’t need to turn to the competition, all while increasing your mortgage revenue and generating non-interest income.

How You Can Learn More

This page goes into greater detail on exactly how we provide support and partner with credit unions.

You can also call Del Smith, our Senior VP of Business Development, to get answers to any questions about partnering with MAM.

Disclaimer:

This information is solely for credit union and mortgage professionals and should not be distributed or provided to consumers or the general public.

This is not an offer for extension of credit nor a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. Certain restrictions may apply. All approvals subject to underwriting guidelines. Not all applicants will qualify. Member Advantage Mortgage, LLC is an Equal Housing Lender. We do business in accordance with the Federal Fair Housing Law and the Equal Credit Opportunity Act.

Member Advantage Mortgage, LLC NMLS #1557. Alabama Consumer Credit License # 22717. Arkansas Combination Mortgage Banker-Broker-Servicer License # 104160. Colorado, Regulated by the Division of Real Estate, Mortgage Company Registration NMLS ID # 1557; check the license status of your mortgage loan originator at http://www.dora.state.co.us/real-estate/index.htm. Connecticut Mortgage Lender License # ML-1557. District of Columbia Mortgage Lender License # MLB1557. Delaware Lender License # 011515. Florida Mortgage Lender License # MLD781. Georgia Residential Mortgage Licensee, License # 36659. Louisiana Residential Mortgage Lending License NMLS ID # 1557. Massachusetts Mortgage Lender License # ML1557. Maryland Mortgage Lender License # 06-19371. Michigan 1st Mortgage Broker/Lender/Servicer Registrant # FR020440. Licensed by the North Carolina Commissioner of Banks, Mortgage Lender License #167098. Licensed by the New Hampshire Banking Department. New Hampshire Mortgage Banker License # 14242-MB. Licensed by the New Jersey Department of Banking and Insurance. New Jersey Residential Mortgage Lender License NMLS ID # 1557. Licensed by Pennsylvania Department of Banking. Pennsylvania Mortgage Lender License # 33868. Rhode Island Licensed Lender, License # 20112778LL. South Carolina Mortgage Lender License #1557. Texas Mortgage Banker Registration NMLS ID # 1557. Licensed by the Virginia State Corporation Commission, Virginia Lender License # MC-5045, Virginia Broker License #MC-5045. NMLS ID # 1557.

Visit www.nmlsconsumeraccess.org for complete licensing information.