Unlock your mortgage advantage

Member Advantage Mortgage (MAM) is a credit union service organization (CUSO) committed to providing you and your members a premium mortgage experience: great products, competitive rates, and personalized service.

Better mortgages mean more member value.

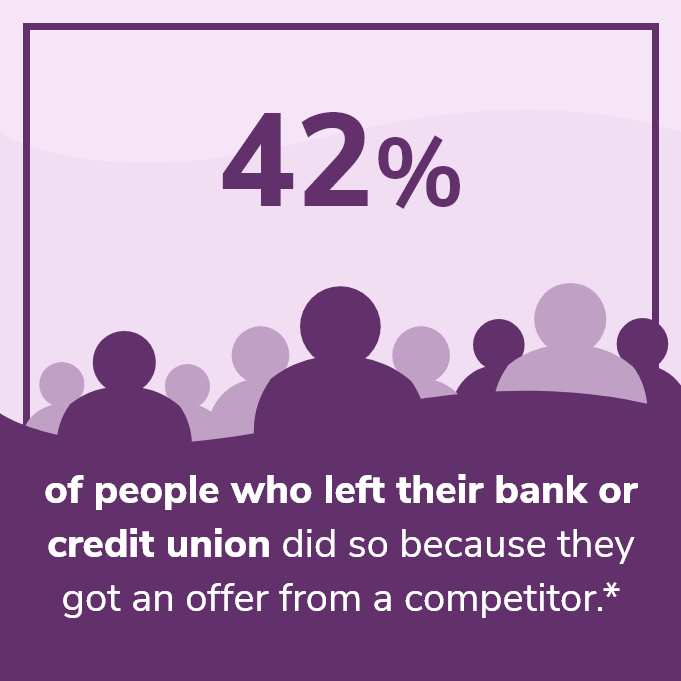

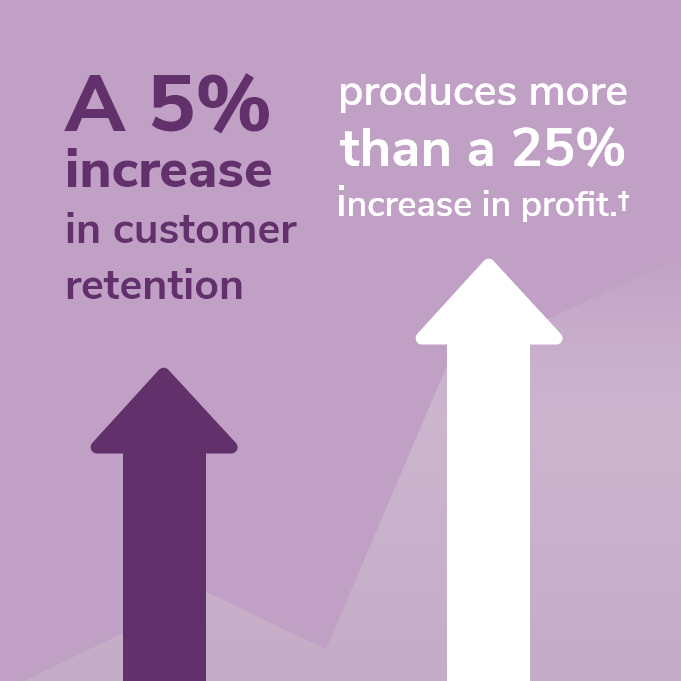

Mortgages boost member loyalty

Members need mortgages. Credit unions that offer mortgages deepen their relationships with members and retain more members.

Better retention

Sell other products

Higher earnings

Whether you want to start offering mortgages or strengthen your existing mortgage loan programs, Member Advantage Mortgage can help.

Discover how UMassFive College Credit Union deepened member relationships by partnering with Member Advantage Mortgage.

More than a mortgage CUSO

Providing a great mortgage experience for your members requires more than just handing them an application. When you partner with MAM, you get marketing support and an approach tailored to your needs.

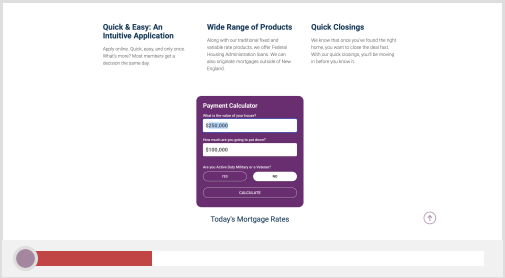

Digital lead-gen tools

Our suite of digital lead-generation tools includes online mortgage calculators that can be integrated into your website. They help you reach existing members and attract new ones.

Turnkey mortgage services

From marketing mortgage loans to closing and servicing loans, we offer a full suite of mortgage solutions. Our offerings include sales, marketing, compliance, operations, servicing, and secondary markets.

A full suite of mortgage products

and solutions

Your members have a wide variety of mortgage needs — from traditional 30-year loans and FHA to Veterans Administration mortgages and other products. We offer a range of standard and custom mortgage products. With our long-term underwriting experience, we can also help you offer safe, effective, and compliant mortgage solutions, such as home equity lines of credit and home equity loans.

Collaborative partnership

We work as an extension of your team to design and deliver a member-centered mortgage experience that fits your credit union. We apply the experience gained from other partnerships, plus the insights you have about your members and your market, to craft a competitive mortgage program for your credit union.

Marketing assets

We have a robust library of marketing assets, including digital and collateral templates, emails, website articles, video and more. These resources can strengthen your mortgage marketing efforts, helping you attract and retain members.

Member service is at the heart of our purpose and culture. Every credit union and every credit union member we work with also gets:

Exceptional

member service

Experienced mortgage professionals

Always up-to-date

compliance practices

How do you want to work with us?

Whether your credit union has never offered mortgages, or you’re simply not satisfied with your current mortgage provider, MAM offers you choices.

Our programs allow you to offer competitive mortgage products to your members while keeping related expenses off your income statement.

Advantage Complete A full service mortgage solution: Members are referred to an experienced, licensed mortgage professional. | Advantage Assist Back office support: Your mortgage loan officer will manage the loan application process. We’ll handle underwriting, closing, funding and secondary market activity. | |

Complete member mortgage experience — sales, back-office support and servicing | ||

No credit union staff required | ||

Co-branded origination and servicing | ||

Credit union branded origination and servicing | ||

Call center mortgage loan officers | ||

Put originated loans on your books or have MAM sell into secondary market | ||

Access to MAM loan origination and lead management systems | ||

Quarterly HMDA data file and audit/exam support | ||

Opportunity to earn origination income on closed loans |

Our vision is to create a premium mortgage experience for members delivered through leading-edge technology and member-focused customer service.

Partner credit unions benefit from our flexibility, commitment to continuous improvement, and the shared learnings from our growing network of credit unions across the country.

We're eager to hear from you...

And to show you how we can provide a solution that fits your mortgage lending needs.

Please feel free to contact us with any questions or comments, and we will respond to you within 24 hours.

*Gerard Du Toit, G. T. and Maureen Burns, M. B. November 2017. Evolving the Customer Experience in Banking. Bain & Company. https://media.bain.com/Images/BAIN_REPORT_Evolving_the_Customer_Experience_in_Banking.pdf

**Charlie Wise, C. W. June 2016. Before and After a Mortgage Event: A Consumer Behavior Study. Transunion. https://www.transunion.com/blog/before-and-after-a-mortgage-event-a-consumer-behavior-study

†Fred Reichheld, F. R. January 2006. Retaining Customers is the Real Challenge. Bain & Company. https://www.bain.com/insights/retaining-customers-is-the-real-challenge/